The Curious Case of Marketability Discounts on Profits Interests

Here at Equity Methods, we’re always intrigued when accounting guidance leads to an unexpected answer. Case in point? Profits interests.

As a reminder, a profits interest is a share of an LLC. A profits interest ultimately pays out based on how much the company’s value rises above a base amount. To avoid taxation upon grant, that baseline is typically set at or above the company’s current market value. The interest is nominally a share, despite behaving like an option: The payoff is zero if the value falls or stays constant, and positive if the value of the company increases.

In short, a profits interest is granted as a share, but its underlying economics are like a stock option.

Because the net payout for these looks like that of an option, it makes sense to ask: Can traditional methods for valuing share-based option awards under ASC 718 be applied to profits interests? Yes, they can. But there’s a caveat relating to the discount for lack of marketability (DLOM).

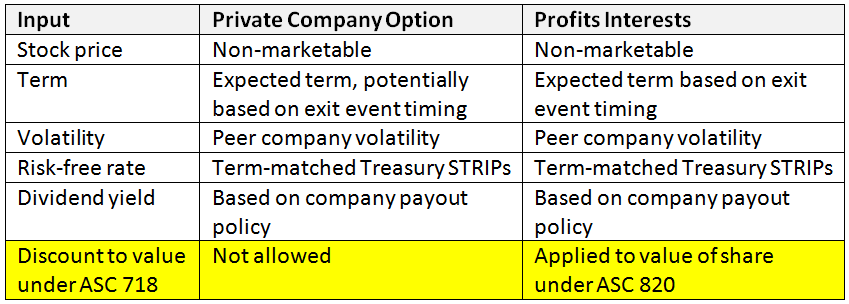

To understand the difference, let’s first compare the accounting treatment of options versus shares under ASC 718. In both cases, we’ll pay close attention to the effect of marketability and how it’s incorporated into the valuation.

Stock Options

For stock options, ASC 718 specifically excludes the application of a discount for lack of marketability. Instead, it allows for the consideration of early exercise in the expected term. This provision takes into account the loss in shareholder value due to the fact that the employee may leave before expiration, need cash and exercise early, or simply choose not to hold the options to their full term. (For details, see ASC 718-10-30-10.)

It’s worth noting that this does result in a substantial discount over the maximum holding term of the option. For example, shifting the expected term from 10 years to 7 years reduces option value by roughly 20%, holding all else constant. The catch? Once the valuation reflects the expected term assumption, no further discounts to the option value are allowed. This is true even for private companies. The reason is that the stock price is already based on a non-marketable indication of value (absent a liquid market to sell the stock into), and the expected term takes into account the additional liquidity constraints facing the holder.

Restricted Stock

The treatment of restricted stock also excludes an extra discount for marketability during the vesting period. If there’s no restriction on sale after the vesting period, you can use the value of a share without a vesting restriction as the fair value without adjustment. If there is a post-vest holding period, you can take an additional discount. Private company issuers, however, can use the value of their equity on a non-marketable basis as the fair value of their restricted stock.

Profits Interests: Shares that pay like options

Despite partially resembling employee stock options and restricted stock, profits interests are fundamentally distinct forms of share-based remuneration. Fundamentally, profits interests are non-marketable shares. They’re issued as minority interests in a private company whose shares are illiquid by nature. Still, you can use option models such as Black-Scholes for the valuation of these shares, because their payoff pattern looks just like an option.

You can use an expected term for profits interests as well. An expected term represents the expected time to receive a payout over which the holder lacks control, resulting in a discount from the full value. As an option-based instrument, a profits interest only delivers value above a particular value—usually the business value at the time of grant.

Additionally, since profits interests are technically restricted stock, you can use a marketability discount on the underlying shares, yielding an even larger discount. This added discounting makes sense when you consider that profits interests are leveraged, option-like shares. That makes them riskier than a company’s standard shares, so they get a larger discount from the marketable price.

The table below summarizes this discussion. Options and profits interests have all the same underlying valuation inputs. But profits interests get a supplemental discount because they’re structured as shares, not options.

Valuing Private Company Employee Options vs. Profits Interests

Common Valuation Mistakes

Given the unique substantive characteristics of profits interests, we’ve seen a number of common errors in practice. Be on the lookout for:

- Failure to model the option-based feature, or trying to use a “rule of thumb” valuation

- Developing the discount for lack of marketability using non-industry practice techniques, as the AICPA’s practice aid “Valuation of Privately-Held-Company Equity Securities Issued as Compensation” prescribes a specific methodology. For example, the valuation technique needs to incorporate the difference in leverage for the profits interest

- Failing to properly incorporate the marketability of the valuation of the overall company

As always, if you find yourself in circumstances where you’re uncertain if your profits interests are being valued appropriately—or if you’d simply like to discuss this topic in more detail—please contact us.